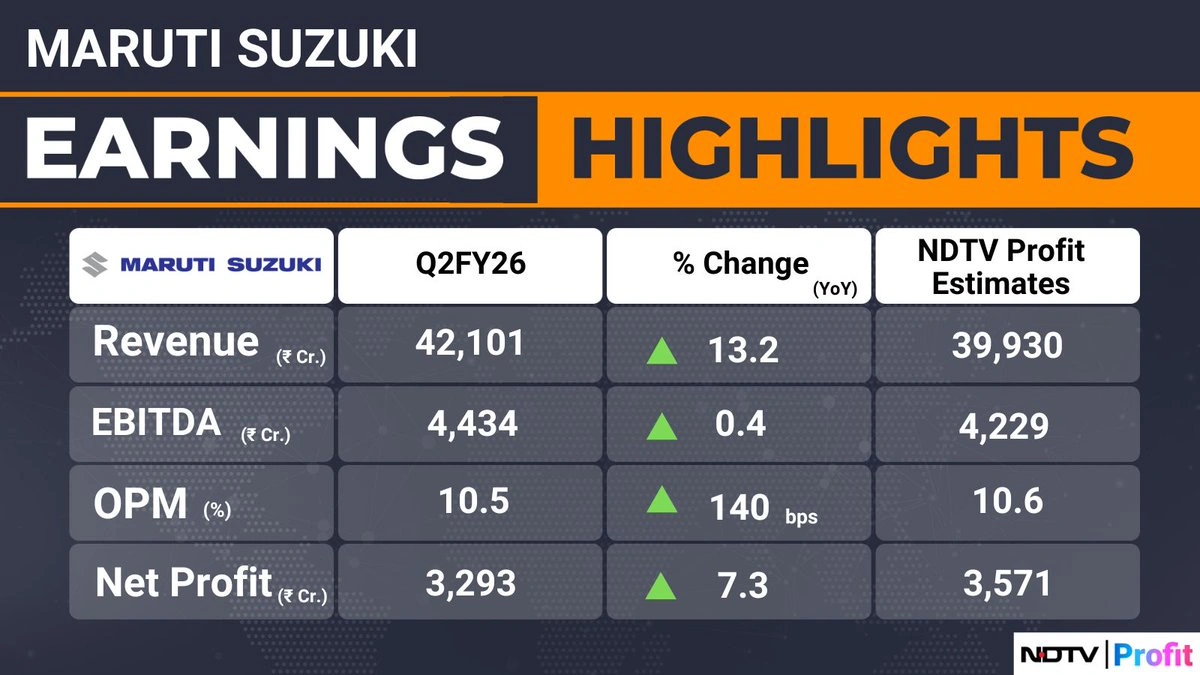

So, Maruti Suzuki just announced an 8% jump in their Q2 profits, hitting a cool ₹3,349 crore. Now, the headlines scream “profit surge,” but let’s be honest – numbers alone don’t tell the whole story. What fascinates me is why this happened, and more importantly, what it means for you, the average Indian consumer, and the overall Indian auto market . Let’s dive into the real story here.

The Real Driver Behind Maruti Suzuki’s Profit | More Than Just Sales

Here’s the thing: a simple increase in car sales doesn’t always translate directly into a profit boost. Several factors are at play. Firstly, look at the global supply chain disruptions that have plagued the auto industry. The availability of semiconductors, for instance, has been a major bottleneck. Maruti’s ability to navigate these challenges more effectively than some of its competitors definitely contributed to its improved profitability. Think of it as being the only shop in town with bread when everyone else is out – you’re bound to make a killing!

And speaking of navigating challenges, consider the rising input costs. Steel, aluminum, and other raw materials have become significantly more expensive. Maruti’s success in managing these costs through operational efficiency , strategic sourcing, and perhaps even some price adjustments (which, let’s face it, we’ve all seen) played a crucial role. What I initially thought was just about higher sales figures turned out to be a masterclass in cost management. So, while competitors struggled with expenses, Maruti optimized.

The Shift in Consumer Preference | Are We Loving SUVs More?

But, let’s not ignore the elephant in the room – changing consumer preferences. India’s love affair with SUVs is no secret. Automakers who adapted to that trend thrived. Did Maruti Suzuki capitalize on this shift? Absolutely. Models like the Brezza and Grand Vitara have been key contributors. The preference for SUVs isn’t just a fad; it represents a shift in needs and desires. People want vehicles that can handle diverse road conditions, offer a sense of safety, and project a certain image. Maruti recognized this early and delivered. Want to read more about the auto market? Here is a link to IPO details .

And it’s not just about SUVs. The demand for CNG vehicles is also on the rise, driven by increasing fuel prices and environmental concerns. Maruti has been a frontrunner in offering CNG options across its portfolio, giving them a distinct advantage. The Q2 results likely reflect the impact of this strategic focus on alternative fuel vehicles.

What This Means For You | The Indian Car Buyer

So, why should you, the potential car buyer, care about Maruti Suzuki’s profit margins? Well, a profitable company is more likely to invest in new technologies, improve product quality, and offer better after-sales service. Let me rephrase that for clarity – a healthy Maruti Suzuki means a healthier ecosystem for car buyers. A company reinvesting in research may lead to a better driving experience for you!

But, there’s also a flip side. Increased profitability could lead to higher prices. But let’s be honest, if Maruti isn’t profitable, they cut jobs or worse. The key is finding a balance between maintaining healthy margins and offering competitive pricing. Keep an eye on how these profits translate into value for the customer – are they offering better features, improved safety, or more attractive financing options? This is where you, as a savvy consumer, need to do your homework and compare offerings across different brands.

Looking Ahead | Challenges and Opportunities for Maruti

While the Q2 results are definitely positive, Maruti Suzuki faces its share of challenges. The increasing competition from both domestic and international players is a major factor. Brands like Tata Motors and Mahindra are giving Maruti a run for its money, and the entry of new players like Kia and MG Motor is further intensifying the competition. Check out Maruti Suzuki’s Wikipedia page .

Furthermore, the transition to electric vehicles (EVs) presents both a challenge and an opportunity. Maruti has been relatively slow in embracing EVs compared to some of its competitors. However, they are expected to launch their first EV in the near future. The success of this launch will be crucial in determining Maruti’s long-term competitiveness. How quickly can Maruti adapt to the changing landscape and embrace new technologies? That’s the million-dollar question.

And, of course, the regulatory environment plays a significant role. Stricter emission norms and safety regulations are increasing compliance costs for all automakers. Maruti’s ability to navigate these regulations efficiently will be key to maintaining its profitability. Regulatory compliance will likely be linked with the adoption of EVs . Here’s a link to another article about the stock market: Stock market information .

Final Thought | The Indian Auto Story Is Just Getting Started

So, Maruti Suzuki’s Q2 profit surge is more than just a number. It’s a reflection of their ability to navigate challenges, adapt to changing consumer preferences, and maintain their dominance in the Indian auto market. But the story is far from over. The road ahead will be filled with both opportunities and challenges, and Maruti’s ability to innovate, adapt, and deliver value to its customers will determine its long-term success. One thing I will say is that as the company expands its vehicle lineup, they may become a key player in the exporting of vehicles . With a strong track record, they could become a valuable asset to India.

FAQ Section

What factors contributed to Maruti Suzuki’s profit increase in Q2?

Several factors contributed, including efficient supply chain management, effective cost control, strategic sourcing, increased SUV sales, and a growing demand for CNG vehicles.

How does Maruti Suzuki’s profitability affect the average car buyer?

A profitable company is more likely to invest in new technologies, improve product quality, and offer better after-sales service, ultimately benefiting the consumer.

What challenges does Maruti Suzuki face in the current market?

Challenges include increasing competition from domestic and international players, the transition to electric vehicles, and stricter regulatory norms.

Is Maruti Suzuki focusing on electric vehicles (EVs)?

Maruti has been relatively slow in embracing EVs but is expected to launch its first EV soon.

How is Maruti Suzuki managing the rising input costs of raw materials?

Maruti is managing costs through operational efficiency, strategic sourcing, and potentially some price adjustments.

How are supply chain disruptions impacting Maruti Suzuki’s profitability?

Maruti Suzuki’s ability to navigate supply chain disruptions more effectively than its competitors has contributed to its improved profitability.